👋 Hey everyone and welcome to this new video. If you’re new here, I’m Hugo Rauch, and my goal is to help founders accelerate their growth, successfully fundraise and find inspirations from startup stories.

Last week, Substack launched a new way to consume videos. Leveraging this feature, I’d love to bring you 3-5 min clips that explain a startup concept. Let’s get started!

What is a Venture Studio?

Who better than Dallas Price., a Venture Builder at Forum Ventures, to answer this questions. Here is Dallas’ curated explanation:

There are 4 key types of organizations: Venture Funds, Accelerators, Venture Studios, and Development Shops. While they might seem similar on the surface, each plays a distinct role in the startup ecosystem.

Venture Funds (Seed Funds):

Venture Funds primarily provide cash to startups, along with a little bit of support. In exchange, they take a smaller equity stake in the company. Their involvement is mostly financial, with minimal hands-on support beyond capital.

Accelerators:

Accelerators offer less cash than venture funds but provide significantly more support. This support can include mentorship, networking opportunities, and business resources. In return, they take a slightly larger equity stake compared to venture funds.

Development Shops (Service Providers):

Development shops focus on delivering specific services, such as software development, in exchange for cash. They do not take equity and are not involved in the business beyond the services they are contracted to provide.

Venture Studios:

Venture Studios stand out by offering a combination of cash and extensive hands-on support. They act as true co-founders, not only providing capital but also writing code, designing, and getting deeply involved in the day-to-day operations of the business. This also means they take a larger equity share.

In most cases, think about studios as giving cash and writing code. Other organizations typically offer one but not both of these services. For example, development shops write code but don't provide funding, while venture funds provide cash but don’t offer technical services.

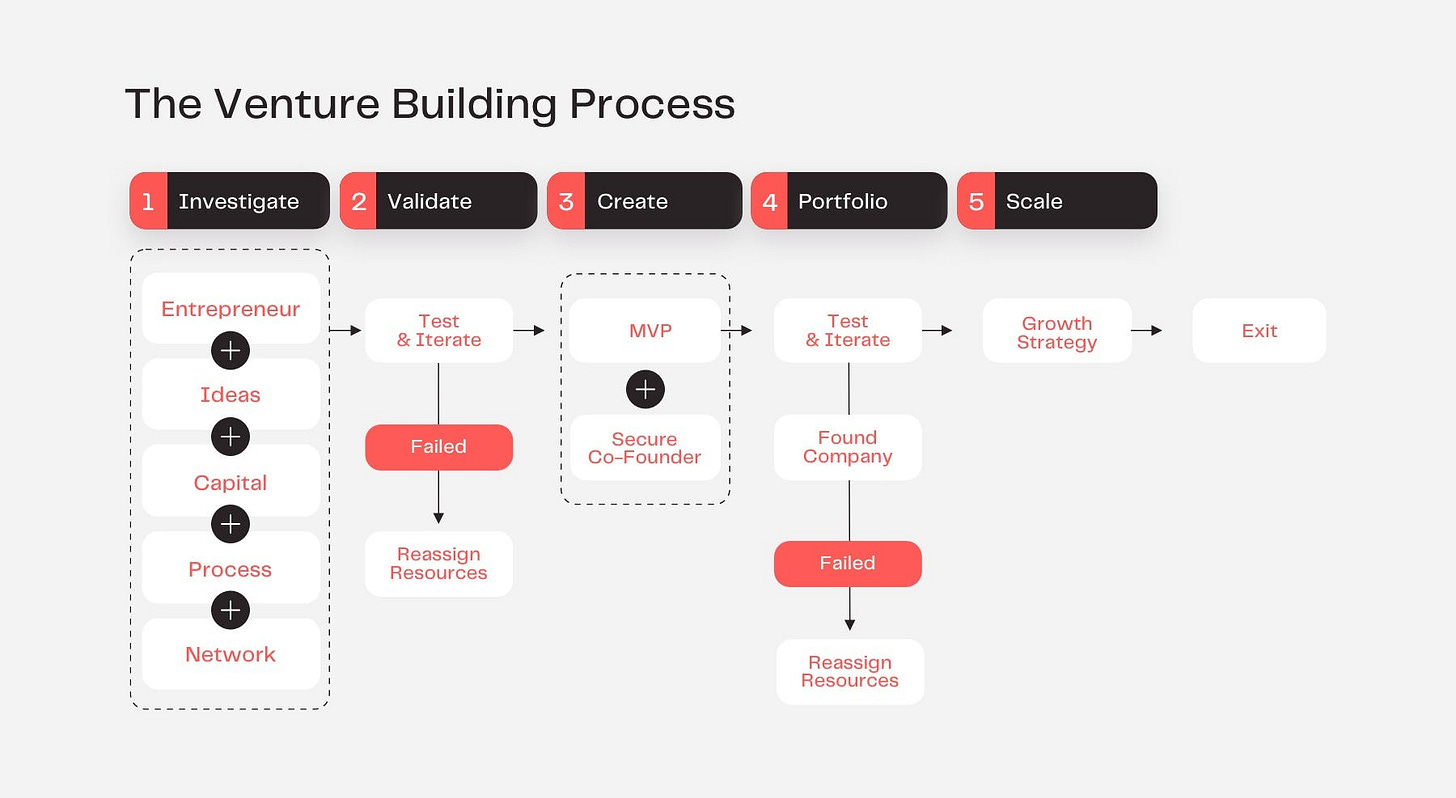

Here is a visual that summarizes how things work:

Let me know what you think of this new format 👇

Cheers,

Hugo 👋

Share this post