👋 Hey everyone, I’m Hugo, the founder of VCo2, the media platform that makes you a better impact investor and climate tech entrepreneur.

What is a climate-tech startup?

Climate-tech startups are businesses that develop solutions to mitigate or adapt to the effects of climate change. These companies operate across diverse sectors and industries including:

renewable energy & energy transition

carbon capture & industrial decarbonization

waste management & circular economy

sustainable agriculture & food systems

electrification & mobility

water management & climate adaptation

Their mission?

To create profitable business models while driving positive climate impact and either reducing greenhouse gas emissions, conserving resources, or fostering a circular economy.

Evolution of climate investment by vertical since 2020:

Who are the climate-tech investors?

Investors in climate-tech span a broad spectrum - from venture capital firms (VCs) to corporate venture capital (CVC), angel investors, private equity, and institutional funds.

Most active investors by stage and number of deals in 2023:

What catches their eye?

According to a survey with 7 VCs by EU-startups, here’s what matters most:

1️⃣ A dedicated team tackling a big problem in a large market. This is standard across all VCs (not only in climate tech).

2️⃣ Alignment with the fund’s investment thesis. This is a dealbreaker, don’t send your deck to VCs if you don’t fit their thesis.

3️⃣ Significant carbon reduction potential (AENU invests only invests in technologies that have the potential to abate or reduce 100 Mt CO2 emissions) and a scalable technology solution.

4️⃣ Deep market knowledge and strong innovation-to-revenue pathways.

5️⃣ Clear alignment between impact and revenue.

6️⃣ Measurable impact aligned with global climate goals.

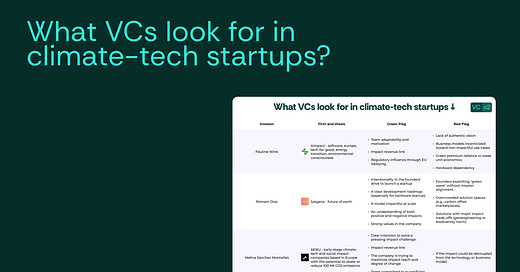

Green and Red Flags:

🟢 Green flags:

Fast time-to-impact and high technology defensibility.

Proprietary IP and unique positioning.

Focus on hard-to-abate industries resistant to innovation.

Regulatory incentives supporting adoption.

Founders with intentionality and a clear vision for impact.

Sound cap table promoting aligned goals.

Substantial market demand and growth potential.

Ability to move fast and adapt to changes in market.

Intentionality in the founders’ drive to launch an impact startup.

🔴 Red Flag

"Dirty" cap tables, misaligned incentives, poor governance.

Negative environmental impacts beyond carbon emissions (biodiversity).

Saturated “red ocean” markets with well-funded competitors.

Weak market validation (no customer demand, pilot projects or partnerships).

High capital intensity with no path to profitability.

Overreliance on the green premium ("customers will pay more for greener").

Lack of clear and significant environmental impact.

Weak market potential or no scalability.

Poor alignment with climate or regulatory frameworks.

Lack of commitment, expertise, or authenticity in the team.

That’s it for today! I hope this made you a smarter impact investor or boosted your chances of securing funding as a climate-tech entrepreneur.

Cheers,

👋 Hugo.

Articles you might like:

💰 The founder’s guide to SAFE Notes

🎨 The founder’s guide to building a pitch deck

Podcast you might like:

🎙️ Financing the climate transition - Jacqueline Van Den Ende (Carbon Equity)

Subscribe to VCo2:

🔴 YouTube | 🌐 LinkedIn | 🗞️ Newsletter | 🎧 Spotify | 🎧 Apple Podcast

What matters most in climate startups?

Great article!