👋 Hey everyone, welcome to the newsletter. I’m Hugo Rauch, and I’m here to help founders accelerate growth and secure funding successfully.

Before we start, shoutout to my friend Tim He, who is launching a free newsletter on co-founder relationships. With 65% of startups failing due to co-founder conflicts, Tim's newsletter, Cherrytree, aims to help founders beat the odds. Subscribe and show Tim the power of our community. 💚

Here is how VCs assess your startup 👇

Understanding what matters to investors is the key to fundraising.

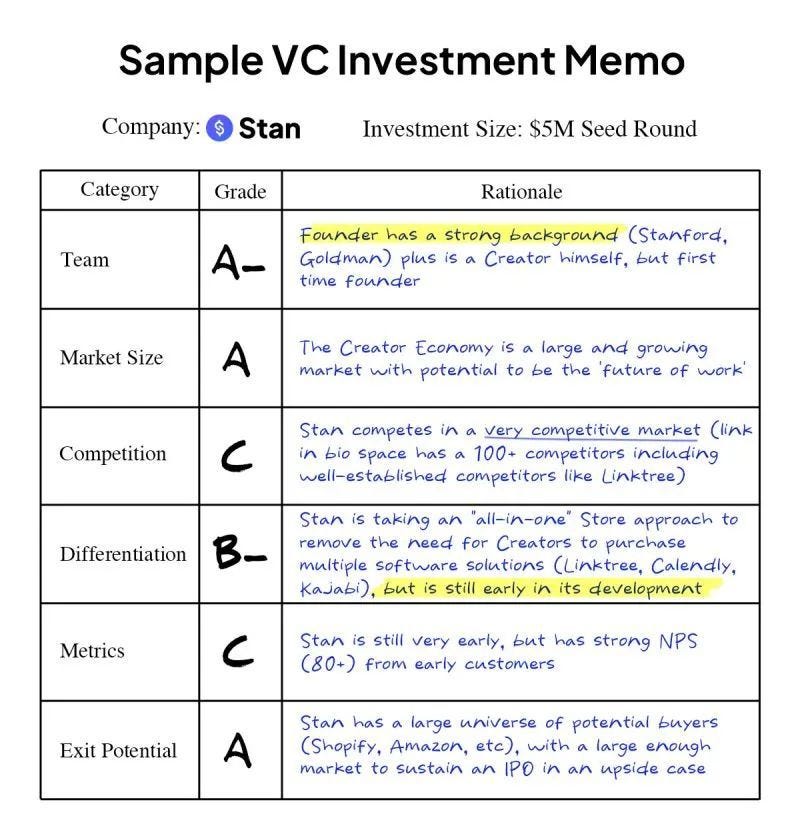

Today, we’re breaking down the VC scorecard shared by John Hu, former VC at Norwest Venture Partners.

Here are the five categories VCs use to assess your startup:

→ Team:

Investors want a team that’s capable, resilient, and equipped to scale a business. Here’s what they’re looking for:

Founders’ Backgrounds: Do the founders bring relevant expertise? Industry knowledge and skills are the foundation.

Complementary Skills: Are the founders’ skill sets diverse yet complementary? A balanced team can handle the technical, operational, and business challenges.

Cohesion and Dynamics: How well does the team work together? Strong chemistry and a shared vision are key.

Key Hires and Growth: Who do you need on board to scale effectively? VCs want to know if there are critical hires planned, such as in engineering, sales, or marketing, to bring the business forward.

→ 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲:

A large and growing market indicates the potential for significant returns, making it a high priority for investors.

Market Size: Quantify your market. Is it worth billions, or does it serve a niche?

Market Growth Rate: Is your market expanding quickly?

Market Type: Are you in an emerging market with limited competition or an established market where disruption is possible?

Saturation and Competition: Can you demonstrate your approach to handle competitors and capture market share?

📍A small favor: I am starting my 🔴YouTube🔴 journey where you’ll learn alongside me as I become a venture capital investor. It’d really help if you could subscribe to the channel. Here's the link: How VCs Think.

→ 𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝗼𝗻:

How VCs want to see you ↓

VCs know that competition can both validate the opportunity and create significant challenges. Here’s what they look at:

Competitors Landscape: Who else is offering solutions similar to yours? How is your solution different? What are your competitors’ strength?

Barriers to Entry: What are the barriers to entry? Patents, technology, or brand that makes it harder for new entrants. How can you keep your advantage?

→ 𝗗𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁𝗶𝗮𝘁𝗶𝗼𝗻:

VCs want to understand your edge over competitors. A unique approach or feature can be the deciding factor in a VC’s assessment.

Unique Value Proposition: How do you solve the problem, and why are you the best at it? Clearly articulate what makes your solution unique and why it matters to customers.

Technology: Is there an innovation or proprietary technology that sets you apart?

Scalability of Differentiation: Can you maintain your edge as you scale?

→ 𝗠𝗲𝘁𝗿𝗶𝗰𝘀:

Solid metrics serve as validation of demand and growth potential. VCs look for startups that can demonstrate traction and growth through the following:

Revenue Growth: Are your revenues steadily increasing?

Customer Acquisition Cost (CAC) and Lifetime Value (LTV): Do you acquire customers cost-effectively, and do they generate sufficient revenue over time?

Churn Rate: How many customers do you lose over a period? A low churn rate shows customer satisfaction, VCs love it.

Unit Economics: Are you generating profit on a per-customer basis?

→ 𝗘𝘅𝗶𝘁 𝗣𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹:

How VCs look at your startup. ↓

This one is debatable. Some investors don’t like when founders come in with an exit strategy. To those that like it, it signals that there’s a path to financial returns, whether through acquisition or an IPO.

Potential Acquirers: Who could be interested in acquiring your company?

Strategic Fit: Why would these companies want to acquire your startup?

Timing of Potential Exit: When might an acquisition or IPO be feasible?

→ How to best use this?

Consider adding an Investment Highlights slide right after your cover slide to keep VCs focused. By highlighting your strengths early on, you can guide their scoring and leave a memorable impact.

Better yet, tailor each slide to the key points above—make it easy for investors to absorb the essentials. When you control the flow, you’re setting yourself up for a smoother, more impactful pitch.

Another exercise would be to rate your own startups by using grades from 0 to 10. A good grade would be above 7/10.

💚 Other articles you might like

If you found this newsletter valuable, please consider sharing it with other founders. We’re all stronger when we support each other’s growth. And as always, feel free to reach out - I’m here to help.

Hugo 👋

Get in touch with me:

🔴 YouTube | 🌐 LinkedIn | 🗞️ Newsletter | 🎧 Spotify - Apple Podcast

I also like to focus on the GTM strategy :)

Can you unpack just how important patents are to VCs?